QuantMomo had another great year for Calendar Year 2024. Continuing our quest to democratize Quantitative rules-based investing, 2024 was all about onboarding customers to the platform and enabling them to participate in the investment process aided by a mobile app. We successfully integrated the platform with an online Indian stock broker, AngelOne, and are continuing to invest in integrating with other brokers. The app will be on the Apple App Store and the Android Play store to begin 2025. It will be open to users to download and allocate capital on an invite basis.

We are expanding our focus to eventually manage investments in addition to providing technology solutions. QuantMomo’s Founder and CEO took the NISM (National Institute of Securities Markets) exams and passed them in India. These exams are a core requirement to register as an Investment Adviser with the Indian regulator SEBI.

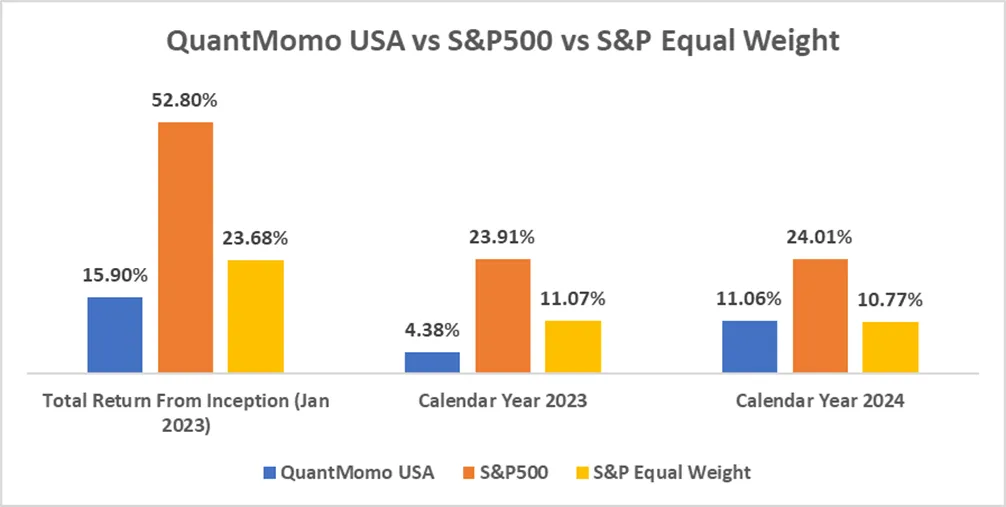

Shifting focus to the Equity Markets in India and US, it was a mixed situation with respect to performance. The US markets did spectacularly well with the S&P500 achieving 24% returns while NIFTY500 in India did ok with 15% performance in the Calendar Year. QuantMomo’s momentum strategy underperformed in both US and India. A detailed description of the performance of various strategies is in the sections below.

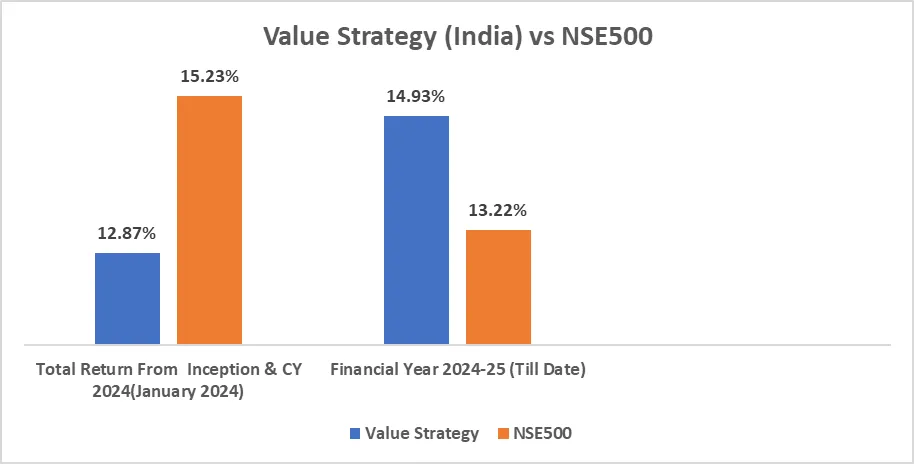

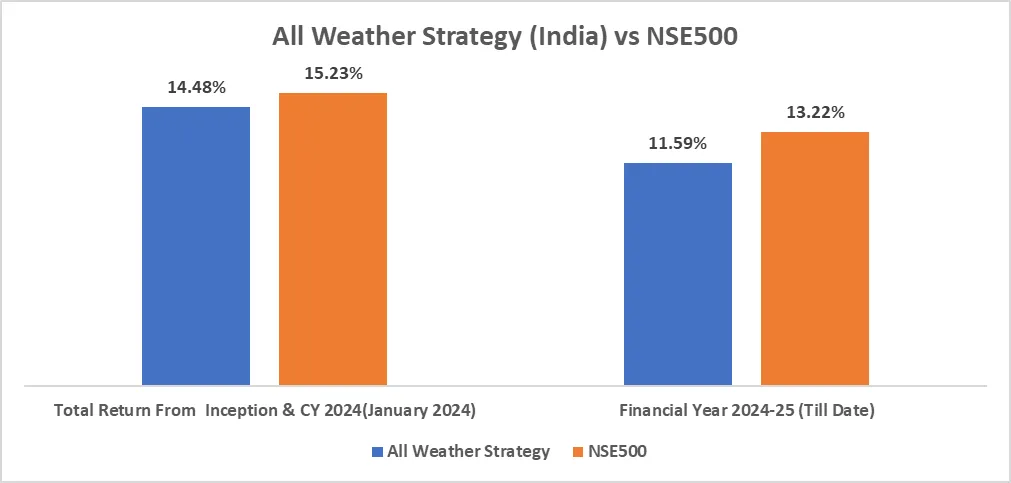

In 2024, we also started allocating our own capital to two more strategies: Value and All Weather. The goal of the value strategy was to identify stocks that offered the best value in terms of its fundamentals (Main focus was on how the firm invested capital and generated returns to its shareholders). The All-Weather strategy’s goal was to provide a way for investors to sleep well at night and create positive returns. Both these strategies produced good returns but could not beat the market (produce alpha).

In summary, 2024 was a very positive year for the markets in India and US. QuantMomo’s strategies also performed well with an overall positive performance.

As we close out 2024, we are very excited about 2025 and the opportunities ahead for QauntMomo. We are pleased about the progress we have made in 2024 and the support we have received from our customers and advisers. I want to thank the entire QuantMomo community of customers, advisers, and employees. Our focus in 2025 will include more product development, customer onboarding, partnerships, and continued investment in pursuing additional strategies. I am super excited about 2025 and the many more milestones that we will achieve.

The Momentum strategy that we introduced in the beginning of 2023 has seen two full years of performance. The strategy outperformed in India in 2023. However, the same strategy has underperformed in 2024 both in India and US. There are a few reasons for the overall behavior of the algorithm and its underperformance:

However, since the algorithm is rules-based, underperformance for one year does not make a trend and the performance needs to be looked at cumulatively. Most investors forget that the strategies are not trading strategies and are investment strategies. From now on, our emphasis will be skewed towards India as investors can pursue many different products in the US.

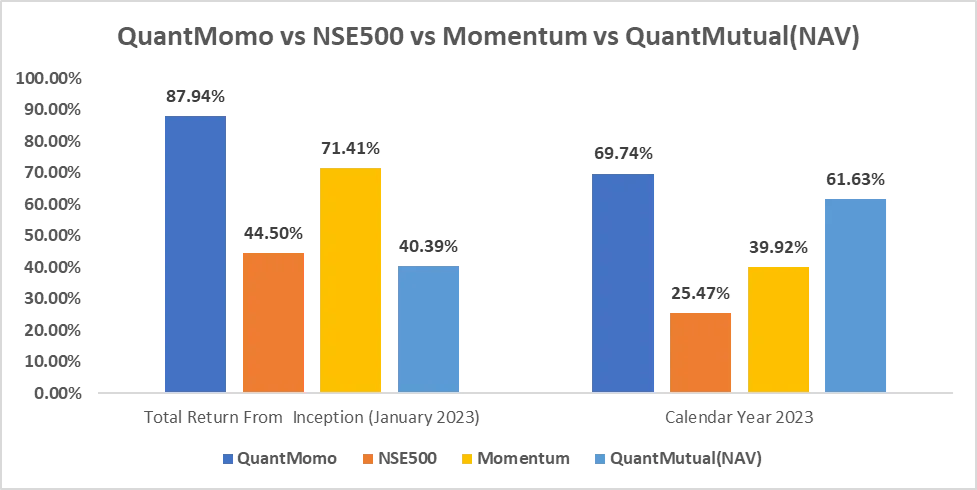

Starting with this year, we will take a slightly different approach to report performance and align with the standard that is used by Fund Managers. We will also be comparing the Momentum Algo’s performance with an ETF — MOMENTUM (Aditya Birla Sunlife NIFTY200 Momentum 30 ETF) and a Mutual Fund (QuantMutual Momentum Fund Regular) and the usual NIFTY500 Index which is the benchmark that is used to pick stocks with Momentum.

QuantMomo India vs NSE500 vs Other competitive Momentum Funds:

| QuantMomo | NIFTY 500 | Momentum | QuantMutual (NAV) | |

|---|---|---|---|---|

| Total Return Since Inception (Jan 2023) | 87.94% | 44.85% | 71.41% | 40.39% |

| Calendar Year 2023 | 69.74% | 25.47% | 39.92% | 61.63% |

| Calendar Year 2024 | 10.72% | 15.51% | 22.19% | 11.49% |

| Financial Year 2023-24 | 110.27% | 38.72% | 69.49% | 33.50% |

| Financial Year 2024-25 (Till Date) | 1.67% | 9.46% | 6.70% | 2.98% |

The QuantMomo Momentum Algorithm is leading the pack since its inception in January 2023. However, the algorithm is trailing in both Calendar Year and Financial Year 2024. The market action in India has been a bit unsettling in the past few months given a lot of chatter around various aspects such as flight of capital from Foreign Institutional Investors and government policies etc., We see similar performance from most of the Momentum Funds in the India Market as we look at monthly performances. The momentum funds in India rebalance every 3 months and also use fundamentals to pick stocks. While the claim is that they are rules based, there seems to be some element of discretion with the fund manager.

QuantMomo’s algorithm is hands-off and completely rules based. The rules of the algorithm are very similar to what most of the US Quant funds use. We have documented some of the rules in one of our previous blogs on our website.

We will continue to monitor the performance and report at the end of the Fiscal Year on March 31st 2025.

We introduced the Value Strategy at the beginning of 2024 where we selected a bunch of value stocks based on a few rules around the company fundamentals and this strategy has produced a positive performance. While the strategy failed to produce alpha (returns above the NSE500), the stocks all contributed healthy dividends. The performance below does not include dividends.

Like the value strategy, we also introduced an all-weather strategy which is composed of 5 different assets — NSE500 Index (equity), Gold (Metal), Silver (Metal), 5 year Gilt (bonds) and Long Term Gilts (Bonds) in a fixed ratio allocation. This strategy also performed well and as expected did not experience violent drawdowns like the equity market experienced. Gold and Silver performed extremely well for the year and the overall performance of the portfolio was close to that of the stock market but without the drawdowns.

The US momentum strategy underperformed the market significantly but was closer in performance to the S&P500 Equal weighted index. In the US the markets are becoming extremely concentrated with only a few (10 or less) mega cap stocks driving the overall performance of the index.

The momentum strategy is an investment strategy, not a trading strategy, so rules are followed to achieve long-term outperformance. As noted above, going forward our focus will be on the markets in India.