December was another crazy month in the markets both in the US and in India. In the US, we saw a rally during the beginning of the month with various asset classes performing very well and then had a rough ending to the year. The proverbial santa claus rally period which is the time between December 26th and January 3rd produced a negative return. In India too, the markets were very volatile and the NSE500 closed with a negative performance.

The focus of the stock markets now shifts to what the calendar year 2025 has in store from an economic, data and business cycle perspective. In the US, there is a lot to look forward to with respect to the policies of the new administration which is expected to be sworn in on the 20th of January followed by earnings reports of Q4 and a variety of economic data. It will be an interesting year on multiple fronts as the market produced 20% returns sequentially for 2 years (2023 and 2024).

In India too there are a lot of things to look forward to. First, the Fiscal year ends on March 31st 2025 and it remains to be seen where the indexes and markets go. Second, there are a variety of tax discussions and market regulations from SEBI that can impact markets. Last but not least, policies of the government, the economy and earnings will also be interesting to watch.

We have published a detailed review of the performance in 2024 (Link below).

Going forward in 2025 and beyond, our focus will be on strategies in the Indian Markets. We will stop tracking the US Momentum strategy and reporting it. If there is interest in the strategy, reach out to us and we will be happy to help you.

The markets continued their rally on the back of the election results both in November and in the beginning of December. The rally reversed and markets fell after the FOMC (Federal Open Market Committee) meeting on December 18th. The Federal Reserve cut the short-term rates (Interbank) by 25 basis points or 0.25% and at the press conference, the fed said that they will be cautious about the future path of rates based on Inflation data. The Inflation rate is still higher than the Fed’s target rate of 2%.

The markets responded negatively to the rates as well as the forecast for future rates which was published after the FOMC meeting. By the end of December, the S&P500 which was around 6100 came down to the 5900 range. Across the board, there was selling in the markets in the last 2 weeks of December. The S&P500 was down -2.74% while the equal weight index was down -6.44%. Momentum stocks also performed poorly with QuantMomo’s momentum strategy also losing -6.25%. From the statistics below, only two momentum stocks produced any positive performance for the month.

| Stock Symbol | Purchase Price | Number of Shares | Current Price | Profit/Loss per Share | Profit/Loss % |

|---|---|---|---|---|---|

| PLTR | $67.44 | 7 | $75.63 | $57.33 | 12.14% |

| GEV | $335.73 | 2 | $328.93 | ($13.60) | -2.03% |

| AXON | $649.20 | 1 | $594.32 | ($54.88) | -8.45% |

| UAL | $97.29 | 11 | $97.10 | ($2.09) | -0.20% |

| VST | $161.60 | 4 | $137.87 | ($94.92) | -14.68% |

| FICO | $2,376.67 | 1 | $1,990.93 | ($385.74) | -16.23% |

| FTNT | $95.36 | 9 | $94.48 | ($7.92) | -0.92% |

| TRGP | $204.46 | 7 | $178.50 | ($181.72) | -12.70% |

| CBRE | $140.12 | 11 | $131.29 | ($97.13) | -6.30% |

| BX | $191.72 | 8 | $172.42 | ($154.40) | -10.07% |

| DAY | $80.10 | 15 | $72.64 | ($111.90) | -9.31% |

| FFIV | $250.00 | 10 | $251.47 | $14.70 | 0.59% |

| FI | $222.00 | 10 | $205.42 | ($165.80) | -7.47% |

| ETR | $78.11 | 20 | $75.82 | ($45.80) | -2.93% |

| KKR | $163.08 | 7 | $147.91 | ($106.19) | -9.30% |

| PYPL | $86.55 | 19 | $85.35 | ($22.80) | -1.39% |

| BMY | $59.40 | 17 | $56.56 | ($48.28) | -4.78% |

| MTB | $219.58 | 4 | $188.01 | ($126.28) | -14.38% |

| GILD | $92.53 | 15 | $92.37 | ($2.40) | -0.17% |

| Total | $24,796.32 | $22,246.50 | ($1549.82) | -6.25% |

Following are the cumulative statistics.

The US Momo strategy is up 10.76% for the year, the S&P 500 is up 24.01% and the equal weight index is up 10.93%.

| Date | US MOMO | MOMO P&L % (Total) | S&P 500 | S&P 500 P&L % (Total) | S&P 500 (Equal Weighted Index) | S&P 500 P&L % (Total) (Equal Weighted Index) |

|---|---|---|---|---|---|---|

| 2023-12-29 | $25,000.00 | 0% | 4,742.83 | 0% | 6,401.11 | 0% |

| 2024-01-31 | $25,821.03 | 3.28% | 4,906.19 | 3.44% | 6,419.44 | 0.29% |

| 2024-02-29 | $27,350.58 | 9.40% | 5,137.08 | 8.31% | 6,633.80 | 3.64% |

| 2024-03-28 | $28,689.49 | 14.76% | 5,254.35 | 10.79% | 6,875.88 | 7.42% |

| 2024-04-30 | $26,237.11 | 4.95% | 5,099.96 | 7.53% | 6,588.53 | 2.93% |

| 2024-05-31 | $26,952.98 | 7.81% | 5,222.68 | 10.12% | 6731.41 | 5.16% |

| 2024-06-28 | $26,655.81 | 6.62% | 5,460.48 | 15.13% | 6,663.71 | 4.10% |

| 2024-07-31 | $26,143.53 | 4.57% | 5,522.30 | 16.43% | 6,956.26 | 8.67% |

| 2024-08-30 | $27,436.09 | 9.74% | 5,648.40 | 19.09% | 7,116.28 | 11.17% |

| 2024-09-30 | $28,225.83 | 12.90% | 5,762.46 | 21.50% | 7,269.40 | 13.56% |

| 2024-10-31 | $27,975.98 | 11.90% | 5,705.45 | 20.30% | 7,144.30 | 11.61% |

| 2024-11-29 | $29,930.38 | 19.72% | 6,032.38 | 27.19% | 7,589.91 | 18.57% |

| 2024-12-31 | $27,690.79 | 10.76% | 5,881.63 | 24.01% | 7,100.83 | 10.93% |

It has been a very eventful month in November for the markets. The US stock market rallied on the back of a decisive election victory for Donald Trump who won both the Popular vote and the electoral college. In India, the markets were very volatile with a few news related movements for specific stocks such as Adani Group. Despite the volatility in the Indian Markets, the NIFTY 500 which is a benchmark we track, was only down slightly for the month and is still up a healthy 10% for the Financial Year which began in April 2024. While the markets are near all time highs in India, certain specific stocks such as Swiggy (which recently IPO’d) are up 20%+ and some of the other indexes such as NIFTY 50 and Sensex are also up for the year. In the US, stock markets are now trading at all-time highs and the S&P 500 index breached a key mental level of 6000 and has closed above that now. It remains to be seen where the markets go from here as most of the future policies seem to have been factored in to the Price of most of the stocks.

As the elections wrapped up with a decisive winner, most of the uncertainty in the markets was resolved in a positive way and the focus shifted to future policies of the new administration. In addition, the Federal Reserve also continued their interest rate cut campaign by cutting the rates by 25 basis points again. The inflation data came out and inflation is stuck at 2.8% which is still higher than the Federal Reserve’s 2% target.

The markets digested all the data, the news and appointments of key cabinet positions of the new administration and continued to rally to all-time highs. While most analysts estimated that the S&P 500 would be close to 4800 by the end of 2024, the markets have proven them wrong with the current level of S&P 500 which is greater than 6000. In November 2024, the S&P 500 returned +5.3% and the S&P Equal Weight Index returned +6.24%. QuantMomo’s momentum algorithm outperformed both the indices with a +7.49% gain. A majority of the momentum stocks were up with a couple of them returning over +50% in just one month.

| Stock Symbol | Purchase Price | Number of Shares | Current Price | Profit/Loss per Share | Profit/Loss % |

|---|---|---|---|---|---|

| PLTR | $41.93 | 12 | $67.08 | $301.80 | 59.98% |

| IRM | $124.88 | 9 | $123.67 | $-10.89 | -0.97% |

| GEV | $305.00 | 2 | $334.12 | $58.24 | 9.55% |

| AXON | $426.82 | 3 | $646.96 | $660.42 | 51.58% |

| CBRE | $131.93 | 5 | $139.99 | $40.30 | 6.11% |

| BXP | $81.52 | 10 | $81.99 | $4.70 | 0.58% |

| TRGP | $168.34 | 6 | $204.30 | $215.76 | 21.36% |

| VTR | $65.42 | 17 | $64.07 | $-22.95 | -2.06% |

| MKTX | $287.91 | 5 | $258.69 | $-146.10 | -10.15% |

| MMM | $128.47 | 7 | $133.53 | $35.42 | 3.94% |

| K | $80.59 | 90 | $81.29 | $63.00 | 0.87% |

| GILD | $88.31 | 16 | $92.58 | $68.32 | 4.84% |

| IBM | $207.77 | 4 | $227.41 | $78.56 | 9.45% |

| ORCL | $170.15 | 5 | $184.84 | $73.45 | 8.63% |

| FTNT | $78.18 | 13 | $95.05 | $219.31 | 21.58% |

| AFL | $105.29 | 8 | $114.00 | $69.68 | 8.27% |

| WELL | $135.54 | 6 | $138.18 | $15.84 | 1.95% |

| CHRW | $102.90 | 8 | $105.58 | $21.44 | 2.60% |

| FFIV | $233.79 | 2 | $250.35 | $33.12 | 7.08% |

| Total | $23,763.98 | $25,543.30 | $1779.42 | 7.49% |

Following are the cumulative statistics.

The US Momo strategy is up 19.72% for the year, the S&P 500 is up 27.19% and the equal weight index is up 18.57%.

| Date | US MOMO | MOMO P&L % (Total) | S&P 500 | S&P 500 P&L % (Total) | S&P 500 (Equal Weighted Index) | S&P 500 P&L % (Total) (Equal Weighted Index) |

|---|---|---|---|---|---|---|

| 2023-12-29 | $25,000.00 | 0% | 4,742.83 | 0% | 6,401.11 | 0% |

| 2024-01-31 | $25,821.03 | 3.28% | 4,906.19 | 3.44% | 6,419.44 | 0.29% |

| 2024-02-29 | $27,350.58 | 9.40% | 5,137.08 | 8.31% | 6,633.80 | 3.64% |

| 2024-03-28 | $28,689.49 | 14.76% | 5,254.35 | 10.79% | 6,875.88 | 7.42% |

| 2024-04-30 | $26,237.11 | 4.95% | 5,099.96 | 7.53% | 6,588.53 | 2.93% |

| 2024-05-31 | $26,952.98 | 7.81% | 5,222.68 | 10.12% | 6731.41 | 5.16% |

| 2024-06-28 | $26,655.81 | 6.62% | 5,460.48 | 15.13% | 6,663.71 | 4.10% |

| 2024-07-31 | $26,143.53 | 4.57% | 5,522.30 | 16.43% | 6,956.26 | 8.67% |

| 2024-08-30 | $27,436.09 | 9.74% | 5,648.40 | 19.09% | 7,116.28 | 11.17% |

| 2024-09-30 | $28,225.83 | 12.90% | 5,762.46 | 21.50% | 7,269.40 | 13.56% |

| 2024-10-31 | $27,975.98 | 11.90% | 5,705.45 | 20.30% | 7,144.30 | 11.61% |

| 2024-11-29 | $29,930.38 | 19.72% | 6,032.38 | 27.19% | 7,589.91 | 18.57% |

| Stock Symbol | Trade Date | Number of Shares | Price per Share | BUY/SELL/HOLD | Total |

|---|---|---|---|---|---|

| PLTR | 12/02/2024 | 7 | $67.08 | SELL* | $469.56 |

| GEV | 12/02/2024 | 2 | $334.12 | HOLD* | $668.24 |

| AXON | 12/02/2024 | 1 | $646.96 | SELL* | $646.96 |

| UAL | 12/02/2024 | 11 | $96.83 | BUY | $1,065.13 |

| VST | 12/02/2024 | 4 | $159.84 | BUY | $639.36 |

| FICO | 12/02/2024 | 1 | $2,375.03 | BUY | $2,375.03 |

| FTNT | 12/02/2024 | 9 | $95.05 | SELL* | $855.45 |

| TRGP | 12/02/2024 | 7 | $204.30 | BUY* | $1,430.10 |

| CBRE | 12/02/2024 | 11 | $139.99 | BUY* | $1,539.89 |

| BX | 12/02/2024 | 8 | $191.09 | BUY | $1,528.72 |

| DAY | 12/02/2024 | 15 | $79.99 | BUY | $1,199.85 |

| FFIV | 12/02/2024 | 10 | $250.35 | BUY* | $2,503.50 |

| FI | 12/02/2024 | 10 | $220.96 | BUY | $2,209.60 |

| ETR | 12/02/2024 | 10 | $156.17 | BUY | $1,561.70 |

| KKR | 12/02/2024 | 7 | $162.87 | BUY | $1,140.09 |

| PYPL | 12/02/2024 | 19 | $86.77 | BUY | $1,648.63 |

| BMY | 12/02/2024 | 17 | $59.22 | BUY | $1,006.74 |

| MTB | 12/02/2024 | 4 | $219.99 | BUY | $879.96 |

| GILD | 12/02/2024 | 15 | $92.58 | SELL* | $1,388.70 |

| Total | $24,757.21 |

*We are now updating the BUY/SELL column to correctly reflect the transactions. BUY* means we buy more of an existing stock, SELL* means we sell some of the existing stocks, HOLD* means no change to the quantity of existing stocks.

The trade date for the US is on 12/02/2024 with the close prices as of 11/29/2024.

It has been a mixed picture in the global markets with the US elections looming next week. It appears there is a bit of uncertainty in the election outcomes, which may be moving markets or a mix of macroeconomic factors and earnings reports that are starting to trickle in. The markets in India have sold off for this month despite seasonality which is mostly positive in October. Some Indexes are down more than 6% in the Indian markets. The news stories driving the Indian markets are the FIIs (Foreign Institutional Investors) are liquidating and withdrawing capital before the US election. While this may be the case, the reality is that the prices are down and the momentum algorithms focus on the prices of indexes and the stocks in the index. In the US, stock markets are trading at all-time highs before the election but are range bound at the all-time highs between 5700 and 5850 on the S&P 500 Index. With earnings and the US election in play, the volatility is now back above 20. The election results and the remainder of the earnings reports may drive future price action.

In the US, the focus has now completely shifted to the Election and the incoming Q3 earnings. The initial earnings seems to be a mixed bag in terms of guidance and the price action over the last few days of the month has been volatile when taken in combination with the Election poll results and the close race in each of the swing states. After the election is over, the focus will shift to Fed action and possibly an year-end price action which can be interesting.

Most experts and economists believe that the economy is in great shape despite the tepid GDP growth in the US. The bond markets have repriced the rates higher, especially at the longer end of the curve (10 year) and the metals markets (Gold, Silver, Platinum) have been soaring. Overall, it is a mixed picture across different asset classes. The S&P 500 returned -0.06% and the S&P Equal Weight Index returned -1.14%. QuantMomo’s momentum algorithm also performed and returned slightly negative results of -0.25%. While a majority of the algorithm’s picks were up, the algorithm still underperformed the benchmark index this month.

| Stock Symbol | Purchase Price | Number of Shares | Current Price | Profit/Loss per Share | Profit/Loss % |

|---|---|---|---|---|---|

| IRM | $118.83 | 8 | $123.73 | $37.84 | 3.97% |

| FICO | $1,943.52 | 1 | $1,993.11 | $39.54 | 2.02% |

| VTR | $63.68 | 19 | $65.49 | $25.46 | 2.09% |

| MMM | $136.70 | 9 | $128.47 | -$67.77 | -5.54% |

| CHRW | $110.37 | 13 | $103.04 | -$95.29 | -6.64% |

| UHS | $229.01 | 4 | $204.31 | -$97.12 | -10.62% |

| GEV | $254.98 | 3 | $301.66 | $136.98 | 17.84% |

| WELL | $128.03 | 10 | $134.88 | $65.70 | 5.12% |

| TYL | $583.72 | 3 | $605.59 | $68.79 | 3.94% |

| PM | $121.40 | 13 | $132.70 | $145.60 | 9.22% |

| NEM | $53.45 | 17 | $45.44 | -$142.29 | -15.55% |

| FOX | $38.80 | 33 | $38.96 | $3.63 | 0.28% |

| HWM | $100.25 | 10 | $99.72 | -$2.60 | -0.26% |

| TRGP | $148.01 | 6 | $166.96 | $118.74 | 13.45% |

| FOXA | $42.33 | 29 | $42.00 | -$6.67 | -0.54% |

| AFL | $111.80 | 15 | $104.79 | -$104.70 | -6.24% |

| AMT | $232.56 | 6 | $213.54 | -$119.70 | -8.54% |

| CBRE | $124.48 | 14 | $130.97 | $86.10 | 4.93% |

| PSA | $363.87 | 4 | $329.06 | -$152.96 | -10.41% |

| Total | $24,674.65 | $24,613.93 | -$60.72 | -0.25% |

Following are the cumulative statistics.

The US Momo strategy is up 11.90% for the year, the S&P 500 is up 20.30% and the equal weight index is up 11.61%.

| Date | US MOMO | MOMO P&L % (Total) | S&P 500 | S&P 500 P&L % (Total) | S&P 500 (Equal Weighted Index) | S&P 500 P&L % (Total) (Equal Weighted Index) |

|---|---|---|---|---|---|---|

| 2023-12-29 | $25,000.00 | 0% | 4,742.83 | 0% | 6,401.11 | 0% |

| 2024-01-31 | $25,821.03 | 3.28% | 4,906.19 | 3.44% | 6,419.44 | 0.29% |

| 2024-02-29 | $27,350.58 | 9.40% | 5,137.08 | 8.31% | 6,633.80 | 3.64% |

| 2024-03-28 | $28,689.49 | 14.76% | 5,254.35 | 10.79% | 6,875.88 | 7.42% |

| 2024-04-30 | $26,237.11 | 4.95% | 5,099.96 | 7.53% | 6,588.53 | 2.93% |

| 2024-05-31 | $26,952.98 | 7.81% | 5,222.68 | 10.12% | 6731.41 | 5.16% |

| 2024-06-28 | $26,655.81 | 6.62% | 5,460.48 | 15.13% | 6,663.71 | 4.10% |

| 2024-07-31 | $26,143.53 | 4.57% | 5,522.30 | 16.43% | 6,956.26 | 8.67% |

| 2024-08-30 | $27,436.09 | 9.74% | 5,648.40 | 19.09% | 7,116.28 | 11.17% |

| 2024-09-30 | $28,225.83 | 12.90% | 5,762.46 | 21.50% | 7,269.40 | 13.56% |

| 2024-10-31 | $27,975.98 | 11.90% | 5,705.45 | 20.30% | 7,144.30 | 11.61% |

| Stock Symbol | Trade Date | Number of Shares | Price per Share | BUY/SELL/HOLD | Total |

|---|---|---|---|---|---|

| PLTR | 11/01/2024 | 12 | $41.56 | BUY | $498.72 |

| IRM | 11/01/2024 | 9 | $123.73 | BUY* | $1,113.57 |

| GEV | 11/01/2024 | 2 | $301.66 | SELL* | $603.32 |

| AXON | 11/01/2024 | 3 | $423.50 | BUY | $1,270.50 |

| CBRE | 11/01/2024 | 5 | $130.97 | SELL* | $654.85 |

| BXP | 11/01/2024 | 10 | $80.56 | BUY | $805.60 |

| TRGP | 11/01/2024 | 6 | $166.96 | BUY | $1,001.76 |

| VTR | 11/01/2024 | 17 | $65.49 | SELL* | $1,113.33 |

| MKTX | 11/01/2024 | 5 | $289.42 | BUY | $1,447.10 |

| MMM | 11/01/2024 | 7 | $128.47 | SELL* | $899.29 |

| K | 11/01/2024 | 90 | $80.65 | BUY | $7,258.50 |

| GILD | 11/01/2024 | 16 | $88.82 | BUY | $1,421.12 |

| IBM | 11/01/2024 | 4 | $206.72 | BUY | $826.88 |

| ORCL | 11/01/2024 | 5 | $167.84 | BUY | $839.20 |

| FTNT | 11/01/2024 | 13 | $78.66 | BUY | $1,022.58 |

| AFL | 11/01/2024 | 8 | $104.79 | SELL* | $838.32 |

| WELL | 11/01/2024 | 6 | $134.88 | SELL* | $809.28 |

| CHRW | 11/01/2024 | 8 | $103.04 | SELL* | $824.32 |

| FFIV | 11/01/2024 | 2 | $233.88 | BUY | $467.76 |

| Total | $23,716.00 |

*We are now updating the BUY/SELL column to correctly reflect the transactions. BUY* means we buy more of an existing stock, SELL* means we sell some of the existing stocks, HOLD* means no change to the quantity of existing stocks.

The trade date for the US is on 11/01/2024 with the close prices as of 10/31/2024.

The US and Indian stock markets have been quite resilient in the wake of data and moves by government agencies (mostly in China, US and a few others). September was an up month in both the Indian and US stock markets, both of which we track for benchmarking and stocks that the momentum algorithm picks. In the US, stock markets cheered the short-term interest rate cut by 50 bps from the Federal Reserve (US Central Bank) and the S&P 500 rallied. In India too, the markets rallied with the NIFTY500 closing up. Many analysts in India are calling for a level of 1L for the Sensex by end of 2024. It remains to be seen where the markets go as most of the days in September have been sideways with the market ending up.

In the US, the markets were waiting for data to come in on Inflation, Jobs and the action of the Federal Reserve. On all the fronts data came in as expected and the markets have concluded that the economy will have a no landing or soft landing and the Fed with their 50 bps cut is in charge.

In September 2024, we saw the markets reach all-time highs across the board in all the indexes based on the soft landing/no landing narrative. Many stocks still lag the performance of the index. Gold has rallied to all-time highs and has performed much better than the S&P 500. Additionally, the longer-term bonds (10 years) have also started to fall in price reflecting an increase in the interest rates. Overall, a mixed picture across the markets. However, the S&P 500 returned +4.22% and the S&P Equal Weight Index returned +3.53%. QuantMomo’s momentum algorithm also performed and returned positive results of +2.33%. While a majority of the algorithm’s picks were up, the algorithm still underperformed the benchmark index this month. We will start monitoring the algorithm’s underperformance and understand if the market structure has changed and any implications for the algorithm.

| Stock Symbol | Purchase Price | Number of Shares | Current Price | Profit/Loss per Share | Profit/Loss % |

|---|---|---|---|---|---|

| MMM | $133.01 | 14 | $136.70 | $51.66 | 2.77% |

| NEM | $52.47 | 22 | $53.45 | $21.56 | 1.87% |

| VTR | $61.76 | 28 | $64.13 | $66.36 | 3.84% |

| IRM | $112.86 | 13 | $118.83 | $77.61 | 5.29% |

| TYL | $587.12 | 4 | $583.72 | $-13.60 | -0.58% |

| CHRW | $103.25 | 19 | $110.37 | $135.28 | 6.90% |

| FOX | $38.23 | 30 | $38.80 | $17.10 | 1.49% |

| AAPL | $228.55 | 6 | $232.35 | $22.80 | 1.66% |

| HWM | $97.16 | 12 | $100.25 | $37.08 | 3.18% |

| GDDY | $166.91 | 8 | $156.78 | $-81.04 | -6.07% |

| NVDA | $116.01 | 4 | $120.83 | $19.28 | 4.15% |

| FOXA | $41.26 | 26 | $42.33 | $27.82 | 2.59% |

| TRGP | $146.21 | 9 | $148.01 | $16.20 | 1.23% |

| PM | $123.57 | 14 | $121.40 | $-30.38 | -1.76% |

| GLW | $41.33 | 28 | $45.15 | $106.96 | 9.24% |

| WELL | $120.23 | 14 | $128.03 | $109.20 | 6.49% |

| IP | $47.93 | 26 | $48.85 | $23.92 | 1.92% |

| GS | $507.47 | 2 | $495.11 | $-24.72 | -2.44% |

| Total | $22536.57 | $23,062.58 | $526.01 | 2.33% |

Following are the cumulative statistics.

The US Momo strategy is up 12.90% for the year, the S&P 500 is up 21.50% and the equal weight index is up 13.56%.

| Date | US MOMO | MOMO P&L % (Total) | S&P 500 | S&P 500 P&L % (Total) | S&P 500 (Equal Weighted Index) | S&P 500 P&L % (Total) (Equal Weighted Index) |

|---|---|---|---|---|---|---|

| 2023-12-29 | $25,000.00 | 0% | 4,742.83 | 0% | 6,401.11 | 0% |

| 2024-01-31 | $25,821.03 | 3.28% | 4,906.19 | 3.44% | 6,419.44 | 0.29% |

| 2024-02-29 | $27,350.58 | 9.40% | 5,137.08 | 8.31% | 6,633.80 | 3.64% |

| 2024-03-28 | $28,689.49 | 14.76% | 5,254.35 | 10.79% | 6,875.88 | 7.42% |

| 2024-04-30 | $26,237.11 | 4.95% | 5,099.96 | 7.53% | 6,588.53 | 2.93% |

| 2024-05-31 | $26,952.98 | 7.81% | 5,222.68 | 10.12% | 6731.41 | 5.16% |

| 2024-06-28 | $26,655.81 | 6.62% | 5,460.48 | 15.13% | 6,663.71 | 4.10% |

| 2024-07-31 | $26,143.53 | 4.57% | 5,522.30 | 16.43% | 6,956.26 | 8.67% |

| 2024-08-30 | $27,436.09 | 9.74% | 5,648.40 | 19.09% | 7,116.28 | 11.17% |

| 2024-09-30 | $28,225.83 | 12.90% | 5,762.46 | 21.50% | 7,269.40 | 13.56% |

| Stock Symbol | Trade Date | Number of Shares | Price per Share | BUY/SELL/HOLD | Total |

|---|---|---|---|---|---|

| IRM | 10/01/2024 | 8 | $118.83 | SELL* | $950.64 |

| FICO | 10/01/2024 | 1 | $1,943.52 | BUY | $1,943.52 |

| VTR | 10/01/2024 | 19 | $63.68 | SELL* | $1,209.92 |

| MMM | 10/01/2024 | 9 | $136.70 | SELL* | $1,230.30 |

| CHRW | 10/01/2024 | 13 | $110.37 | SELL* | $1,434.81 |

| UHS | 10/01/2024 | 4 | $229.01 | BUY | $916.04 |

| GEV | 10/01/2024 | 3 | $254.98 | BUY | $764.94 |

| WELL | 10/01/2024 | 10 | $128.03 | SELL* | $1,280.30 |

| TYL | 10/01/2024 | 3 | $583.72 | HOLD* | $1,751.16 |

| PM | 10/01/2024 | 13 | $121.40 | HOLD* | $1,578.20 |

| NEM | 10/01/2024 | 17 | $53.45 | SELL* | $908.65 |

| FOX | 10/01/2024 | 33 | $38.80 | BUY* | $1,280.40 |

| HWM | 10/01/2024 | 10 | $100.25 | SELL* | $1,002.50 |

| TRGP | 10/01/2024 | 6 | $148.01 | SELL* | $888.06 |

| FOXA | 10/01/2024 | 29 | $42.33 | BUY* | $1,227.57 |

| AFL | 10/01/2024 | 15 | $111.80 | BUY | $1,677.00 |

| AMT | 10/01/2024 | 6 | $232.56 | BUY | $1,395.36 |

| CBRE | 10/01/2024 | 14 | $124.48 | BUY | $1,742.72 |

| PSA | 10/01/2024 | 4 | $363.87 | BUY | $1,455.48 |

| Total | $24,637.57 |

*We are now updating the BUY/SELL column to correctly reflect the transactions. BUY* means we buy more of an existing stock, SELL* means we sell some of the existing stocks, HOLD* means no change to the quantity of existing stocks.

The trade date for the US is on 10/01/2024 with the close prices as of 09/30/2024.

The markets globally had some trouble during the beginning of August – Markets in India, Japan, US and Europe sold off, which was attributed to the Japanese Yen Carry Trade and deleveraging effects. In the US, we saw a decline of about 6% in some of the indices and the volatility index (VIX) jumped close to 60 from its normal levels of 15 to 20. Indian markets also fell but the decline was modest (about 1% to 2% depending on the index). While the move was short-lived, it shows us how vulnerable the stock markets are to information and capital flows. The markets recovered completely and are near their all-time highs in both the US and India. As we head into September, there are a few developments in the US markets – The Fed has announced its intent to cut rates, more data about inflation, unemployment and other macroeconomic statistics will be available and finally the presidential debates and election are getting closer. In India too, there will be a slew of economic data released in September as well as many companies that will be issuing dividends and splits.

In the US, the markets began with a significant spike in volatility and a drop but later recovered based on earnings from companies, the Fed’s rate cut signals, and news from Japan about the carry trade. When writing this blog, most companies in the US have reported the earnings for Q2 CY 2024 and the overall S&P earnings have increased close to 10% from Q2 ’23 to Q2′ 24.

For August 2024, the S&P 500 price action has been quite volatile and the intraday price swings have been very wild. With all of that factored in, the S&P closed August 2024 up with a return of +3.70%. The US Momo algorithm performed better than the S&P 500 with a return of -+5.08%. Most of the picks of QuantMomo were up for the month with only 3 names posting negative returns. Additionally, most of the stocks that were up were up more than the returns of the S&P 500. The Equal Weight S&P 500 also rallied and was up +3.40% in August.

| Stock Symbol | Purchase Price | Number of Shares | Current Price | Profit/Loss per Share | Profit/Loss % |

|---|---|---|---|---|---|

| VST | $79.48 | 6 | $85.43 | $35.70 | 7.49% |

| NVDA | $117.60 | 5 | $119.37 | $8.85 | 1.51% |

| FSLR | $219.10 | 3 | $227.37 | $24.81 | 3.77% |

| TER | $128.50 | 4 | $136.73 | $32.92 | 6.40% |

| NTAP | $126.43 | 13 | $120.72 | ($74.23) | -4.52% |

| NEM | $49.25 | 26 | $53.39 | $107.64 | 8.41% |

| TRGP | $135.35 | 17 | $146.90 | $196.35 | 8.53% |

| MMM | $127.50 | 4 | $134.69 | $28.76 | 5.64% |

| NRG | $75.00 | 15 | $85.01 | $150.15 | 13.35% |

| RCL | $157.81 | 7 | $164.62 | $47.67 | 4.32% |

| GE | $170.75 | 6 | $174.62 | $23.22 | 2.27% |

| NEE | $76.32 | 15 | $80.51 | $62.85 | 5.49% |

| GDDY | $146.07 | 16 | $167.41 | $341.44 | 14.61% |

| MU | $107.18 | 7 | $96.24 | ($76.58) | -10.21% |

| IP | $46.39 | 47 | $48.42 | $95.41 | 4.38% |

| GLW | $40.23 | 20 | $41.85 | $32.40 | 4.03% |

| HWM | $96.65 | 8 | $96.66 | $0.08 | 0.01% |

| IRM | $105.00 | 18 | $113.26 | $148.68 | 7.87% |

| GRMN | $171.93 | 10 | $183.29 | $113.60 | 6.61% |

| GOOG | $171.91 | 9 | $165.11 | ($61.20) | -3.96% |

| $24,372.19 | $25,610.71 | $1,238.52 | 5.08% |

Following are the cumulative statistics.

The US Momo strategy is up 9.74% for the year, the S&P 500 is up 19.09% and the equal weight index is up 11.17%.

| Date | US MOMO | MOMO P&L % (Total) | S&P 500 | S&P 500 P&L % (Total) | S&P 500 (Equal Weighted Index) | S&P 500 P&L % (Total) (Equal Weighted Index) |

|---|---|---|---|---|---|---|

| 2023-12-29 | $25,000.00 | 0% | 4,742.83 | 0% | 6,401.11 | 0% |

| 2024-01-31 | $25,821.03 | 3.28% | 4,906.19 | 3.44% | 6,419.44 | 0.29% |

| 2024-02-29 | $27,350.58 | 9.40% | 5,137.08 | 8.31% | 6,633.80 | 3.64% |

| 2024-03-28 | $28,689.49 | 14.76% | 5,254.35 | 10.79% | 6,875.88 | 7.42% |

| 2024-04-30 | $26,237.11 | 4.95% | 5,099.96 | 7.53% | 6,588.53 | 2.93% |

| 2024-05-31 | $26,952.98 | 7.81% | 5,222.68 | 10.12% | 6731.41 | 5.16% |

| 2024-06-28 | $26,655.81 | 6.62% | 5,460.48 | 15.13% | 6,663.71 | 4.10% |

| 2024-07-31 | $26,143.53 | 4.57% | 5,522.30 | 16.43% | 6,956.26 | 8.67% |

| 2024-08-30 | $27,436.09 | 9.74% | 5,648.40 | 19.09% | 7,116.28 | 11.17% |

| Stock Symbol | Trade Date | Number of Shares | Price per Share | BUY/SELL/HOLD | Total |

|---|---|---|---|---|---|

| MMM | 09/03/2024 | 13 | $134.69 | BUY* | $1,750.97 |

| NEM | 09/03/2024 | 20 | $53.39 | SELL* | $1,067.80 |

| VTR | 09/03/2024 | 26 | $62.11 | BUY | $1,614.86 |

| IRM | 09/03/2024 | 12 | $113.26 | SELL* | $1,359.12 |

| TYL | 09/03/2024 | 3 | $587.87 | BUY | $1,763.61 |

| CHRW | 09/03/2024 | 17 | $103.51 | BUY | $1,759.67 |

| FOX | 09/03/2024 | 27 | $38.43 | BUY | $1,037.61 |

| AAPL | 09/03/2024 | 5 | $229.00 | BUY | $1,145.00 |

| HWM | 09/03/2024 | 11 | $96.66 | BUY* | $1,063.26 |

| GDDY | 09/03/2024 | 7 | $167.41 | SELL* | $1,171.87 |

| NVDA | 09/03/2024 | 3 | $119.37 | SELL* | $358.11 |

| FOXA | 09/03/2024 | 24 | $41.37 | BUY | $992.88 |

| TRGP | 09/03/2024 | 8 | $146.90 | SELL* | $1,175.20 |

| PM | 09/03/2024 | 13 | $123.29 | BUY | $1,602.77 |

| GLW | 09/03/2024 | 26 | $41.85 | BUY* | $1,088.10 |

| WELL | 09/03/2024 | 13 | $120.68 | BUY | $1,568.84 |

| IP | 09/03/2024 | 23 | $48.42 | SELL* | $1,113.66 |

| GS | 09/03/2024 | 2 | $510.25 | BUY | $1,020.50 |

| Total | $22,653.83 |

*We are now updating the BUY/SELL column to correctly reflect the transactions. BUY* means we buy more of an existing stock, SELL* means we sell some of the existing stocks, HOLD* means no change to the quantity of existing stocks.

The trade date for the US is on 09/03/2024 with the close prices as of 08/30/2024.

July was an interesting month both in the Indian and US markets. US markets experienced a sell-off in the technology sector and a rally in small-cap stocks. The narratives were around rotation, soft landing, and many others. However, most of the narratives do not do justice in describing the price action of the markets and even of individual stocks & sectors in the market. The Indian markets experienced some volatility during the Indian Budget presented this month. The budget has created a couple of issues for Investors with the Capital Gains taxes being increased on both short-term and long-term investments. The Government increased the Short-Term Capital Gains to 20% and Long-Term Gains to 12.5%. While some people debate that this will curtail activity in the stock markets, we are agnostic about the impact that it can create. The reason for being agnostic is because the taxes are much higher in countries such as the US (Short term is about 35% and long-term is about 15%) and the high taxes have not created any issues with a reduction in market participation. One way to think about taxes is that it is the cost of doing business. As long as there are incentives to make good returns relative to other alternatives, people will continue to participate.

In the US, the markets continued to digest multiple sources of information such as Inflation readings, employment reports and CY Q2 2024 earnings from companies. As of this writing, more than 50% of the companies have reported their earnings with earnings being in line or slightly better.

For July 2024, the S&P500 was very volatile with several up and down moves and as of the writing of this blog, the S&P500 closed up with a return of +0.86%. The US Momo algorithm once again performed poorly compared to the S&P500 and was down -1.85%. Majority of the picks of QuantMomo were down double digits for the month as these were all technology momentum names. The Equal Weight S&P500 rallied significantly for the month of July 2024 and was up +4.71%.

| Stock Symbol | Purchase Price | Number of Shares | Current Price | Profit/Loss per Share | Profit/Loss % |

|---|---|---|---|---|---|

| NVDA | $123.47 | 5 | $117.02 | ($6.45) | -5.22% |

| CEG | $208.19 | 3 | $189.80 | ($18.39) | -8.83% |

| NRG | $78.83 | 12 | $75.17 | ($3.66) | -4.64% |

| MU | $130.50 | 5 | $109.82 | ($20.68) | -15.85% |

| GE | $160.67 | 8 | $170.20 | $9.53 | 5.93% |

| FSLR | $224.75 | 3 | $215.99 | ($8.76) | -3.90% |

| HWM | $78.75 | 17 | $95.70 | $16.95 | 21.52% |

| TRGP | $129.98 | 13 | $135.28 | $5.30 | 4.08% |

| WDC | $76.21 | 13 | $67.05 | ($9.16) | -12.02% |

| QCOM | $199.47 | 4 | $180.95 | ($18.52) | -9.28% |

| SMCI | $831.44 | 1 | $701.65 | ($129.79) | -15.61% |

| NTAP | $129.46 | 13 | $126.98 | ($2.48) | -1.92% |

| APH | $67.74 | 23 | $64.26 | ($3.48) | -5.14% |

| CMG | $62.69 | 14 | $54.32 | ($8.37) | -13.35% |

| AMAT | $236.86 | 4 | $212.20 | ($24.66) | -10.41% |

| PWR | $255.96 | 5 | $265.38 | $9.42 | 3.68% |

| GRMN | $163.00 | 16 | $171.25 | $8.25 | 5.06% |

| TT | $332.78 | 4 | $334.28 | $1.50 | 0.45% |

| LDOS | $146.58 | 18 | $144.40 | ($2.18) | -1.49% |

| TER | $148.00 | 7 | $131.16 | ($16.84) | -11.38% |

| Total | $24,407.99 | $23,957.19 | ($450.80) | -1.85% |

Following are the cumulative statistics.

The US Momo strategy is up 4.57% for the year, the S&P 500 is up 16.43% and the equal weight index is up 8.67%.

| Date | US MOMO | MOMO P&L % (Total) | S&P 500 | S&P 500 P&L % (Total) | S&P 500 (Equal Weighted Index) | S&P 500 P&L % (Total) (Equal Weighted Index) |

|---|---|---|---|---|---|---|

| 2023-12-29 | $25,000.00 | 0% | 4,742.83 | 0% | 6,401.11 | 0% |

| 2024-01-31 | $25,821.03 | 3.28% | 4,906.19 | 3.44% | 6,419.44 | 0.29% |

| 2024-02-29 | $27,350.58 | 9.40% | 5,137.08 | 8.31% | 6,633.80 | 3.64% |

| 2024-03-28 | $28,689.49 | 14.76% | 5,254.35 | 10.79% | 6,875.88 | 7.42% |

| 2024-04-30 | $26,237.11 | 4.95% | 5,099.96 | 7.53% | 6,588.53 | 2.93% |

| 2024-05-31 | $26,952.98 | 7.81% | 5,222.68 | 10.12% | 6731.41 | 5.16% |

| 2024-06-28 | $26,655.81 | 6.62% | 5,460.48 | 15.13% | 6,663.71 | 4.10% |

| 2024-07-31 | $26,143.53 | 4.57% | 5,522.30 | 16.43% | 6,956.26 | 8.67% |

| Stock Symbol | Trade Date | Number of Shares | Price per Share | BUY/SELL/HOLD | Total |

|---|---|---|---|---|---|

| VST | 08/01/2024 | 6 | $79.22 | BUY | $475.32 |

| NVDA | 08/01/2024 | 5 | $117.02 | HOLD* | $585.10 |

| FSLR | 08/01/2024 | 3 | $215.99 | HOLD* | $647.97 |

| TER | 08/01/2024 | 4 | $131.16 | SELL* | $524.64 |

| NTAP | 08/01/2024 | 13 | $126.98 | HOLD* | $1,650.74 |

| NEM | 08/01/2024 | 26 | $49.07 | BUY | $1,275.82 |

| TRGP | 08/01/2024 | 17 | $135.28 | BUY* | $2,299.76 |

| MMM | 08/01/2024 | 4 | $127.55 | BUY | $510.20 |

| NRG | 08/01/2024 | 15 | $75.17 | BUY* | $1,127.55 |

| RCL | 08/01/2024 | 7 | $156.72 | BUY | $1,097.04 |

| GE | 08/01/2024 | 6 | $170.20 | SELL* | $1,021.20 |

| NEE | 08/01/2024 | 15 | $76.39 | BUY | $1,145.85 |

| GDDY | 08/01/2024 | 16 | $145.45 | BUY | $2,327.20 |

| MU | 08/01/2024 | 7 | $109.82 | BUY* | $768.74 |

| IP | 08/01/2024 | 47 | $46.48 | BUY | $2,184.56 |

| GLW | 08/01/2024 | 20 | $40.01 | BUY | $800.20 |

| HWM | 08/01/2024 | 8 | $95.70 | SELL* | $765.60 |

| IRM | 08/01/2024 | 18 | $102.56 | BUY | $1,846.08 |

| GRMN | 08/01/2024 | 10 | $171.25 | SELL* | $1,712.50 |

| GOOG | 08/01/2024 | 9 | $173.15 | BUY | $1,558.35 |

| Total | $24324.42 |

*We are now updating the BUY/SELL column to correctly reflect the transactions. BUY* means we buy more of an existing stock, SELL* means we sell some of the existing stocks, HOLD* means no change to the quantity of existing stocks.

The trade date for the US is on 08/01/2024 with the close prices as of 07/31/2024.

Both the US and Indian markets continued to grind higher for the month of June. The markets in India began the month with a high amount of volatility due to the election, vote counting and the eventual outcome of the election. In the US, the markets continue to grind higher due to the AI narrative and only a few stocks driving up the overall market. The equal-weight S&P index continues to underperform the cap-weighted S&P500 by more than 10%. Now the Q2 CY2024 is over, we focus on the second half of 2024 which should be very interesting given that there are elections in the US, Europe (UK, France) and a bunch of interesting economic policies that will either be floated or acted upon. While all of the events in the world happen, our focus as rules-based strategies continues and the momentum algorithm will pick stocks based on the rules that have been defined, tested and curated by the QuantMomo team.

The US markets mostly continued on the previous gains that were realized in May 2024 and added a bit more to their performance. While the Index is going up, there is a lot of talk about the concentration of the Index in very few stocks which are termed as Magnificent 4 or 7 or even 10 sometimes all led by technology stocks such as NVDA, AMZN, APPL, etc., While QuantMomo focuses on rules-based strategies, it is important to talk about the action as it relates to the index because we use the Index as a performance benchmark. The US market has become bifurcated in terms of stocks like the Mag 4/7/10 and the rest of the stocks. As our readers can observe, most of the time, the momentum algorithm picks stocks that are not part of the Mag 4/7/10 and those are rarely part of the list of stocks picked. Another comparison that we started a while back was to look at the Momentum algorithm performance relative to the S&P equal-weighted index performance which weighs the stocks in the index equally. One main takeaway from all this is that the US stock market is now concentrated to the top cap weighted stocks in the Index and the performance delta between the S&P500 index and the Equal Weight S&P500 index is more than 10%. This is very unusual.

For June 2024, the S&P500 was up +3.35%. The US Momo algorithm once again performed poorly compared to the S&P500 and was down -1.12%. Majority of the picks of QuantMomo were down for the month except NVDA (A Mag4/7/10 pick) and AMAT (Applied materials) both of which are technology stocks and were up more than 8%. The Equal Weight S&P500 was down slightly with a return of -0.13%.

| Stock Symbol | Purchase Price | Number of Shares | Current Price | Profit/Loss per Share | Profit/Loss % |

|---|---|---|---|---|---|

| NVDA | $113.62 | 10 | $123.54 | $9.92 | 8.73% |

| CEG | $215.50 | 3 | $200.27 | ($15.23) | -7.07% |

| GE | $166.12 | 7 | $158.97 | ($7.16) | -4.31% |

| NRG | $80.63 | 7 | $77.83 | ($2.80) | -3.48% |

| MU | $128.13 | 7 | $131.53 | $3.40 | 2.65% |

| WDC | $75.78 | 13 | $75.77 | ($0.01) | -0.01% |

| ETN | $334.00 | 5 | $313.51 | ($20.49) | -6.13% |

| HWM | $85.29 | 16 | $77.66 | ($7.63) | -8.95% |

| CMG | $62.78 | 50 | $62.83 | $0.05 | 0.08% |

| TRGP | $118.23 | 14 | $128.79 | $10.56 | 8.93% |

| TT | $331.53 | 4 | $328.95 | ($2.58) | -0.78% |

| FANG | $198.45 | 8 | $200.19 | $1.74 | 0.88% |

| QCOM | $209.56 | 6 | $199.18 | ($10.38) | -4.95% |

| AMAT | $218.33 | 5 | $235.99 | $17.66 | 8.09% |

| WAB | $170.00 | 11 | $157.91 | ($12.09) | -7.11% |

| APH | $66.39 | 26 | $67.36 | $0.97 | 1.47% |

| AXP | $240.18 | 7 | $231.59 | ($8.59) | -3.58% |

| PWR | $278.27 | 3 | $254.16 | ($24.11) | -8.66% |

| LDOS | $146.67 | 3 | $145.79 | ($0.88) | -0.60% |

| Total | $25,035.57 | $24,755.81 | ($279.76) | -1.12% |

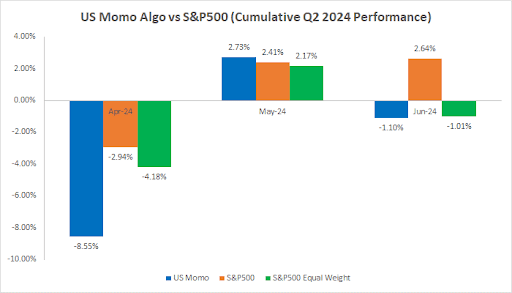

In the US, the momentum algorithm produced -1.10% on a cumulative basis. If one invested $100K in the strategy on April 1st, they would have lost $1100. The S&P500 produced superior results in Q2 2024 driven by the concentration of the cap weighted stocks in the index. The equal weight S&P index had a similar performance to that of the US Momo algorithm.

Following are the cumulative statistics for the first half of the year.

The US Momo strategy is up 6.62% for the year, the S&P 500 is up 15.13% and the equal weight index is up 4.10%.

| Date | US MOMO | MOMO P&L % (Total) | S&P 500 | S&P 500 P&L % (Total) | S&P 500 (Equal Weighted Index) | S&P 500 P&L % (Total) (Equal Weighted Index) |

|---|---|---|---|---|---|---|

| 2023-12-29 | $25,000.00 | 0% | 4,742.83 | 0% | 6,401.11 | 0% |

| 2024-01-31 | $25,821.03 | 3.28% | 4,906.19 | 3.44% | 6,419.44 | 0.29% |

| 2024-02-29 | $27,350.58 | 9.40% | 5,137.08 | 8.31% | 6,633.80 | 3.64% |

| 2024-03-28 | $28,689.49 | 14.76% | 5,254.35 | 10.79% | 6,875.88 | 7.42% |

| 2024-04-30 | $26,237.11 | 4.95% | 5,099.96 | 7.53% | 6,588.53 | 2.93% |

| 2024-05-31 | $26,952.98 | 7.81% | 5,222.68 | 10.12% | 6731.41 | 5.16% |

| 2024-06-28 | $26,655.81 | 6.62% | 5,460.48 | 15.13% | 6,663.71 | 4.10% |

| Stock Symbol | Trade Date | Number of Shares | Price per Share | BUY/SELL/HOLD | Total |

|---|---|---|---|---|---|

| NVDA | 07/01/2024 | 5 | $123.54 | SELL* | $617.70 |

| CEG | 07/01/2024 | 3 | $200.27 | HOLD* | $600.81 |

| NRG | 07/01/2024 | 12 | $77.86 | BUY* | $934.32 |

| MU | 07/01/2024 | 5 | $131.53 | SELL* | $657.65 |

| GE | 07/01/2024 | 8 | $158.97 | BUY* | $1,271.76 |

| FSLR | 07/01/2024 | 3 | $225.46 | BUY | $676.38 |

| HWM | 07/01/2024 | 17 | $77.63 | BUY* | $1,319.71 |

| TRGP | 07/01/2024 | 13 | $128.78 | SELL* | $1,674.14 |

| WDC | 07/01/2024 | 13 | $75.77 | BUY | $985.01 |

| QCOM | 07/01/2024 | 4 | $199.18 | SELL* | $796.72 |

| SMCI | 07/01/2024 | 1 | $819.35 | HOLD* | $819.35 |

| NTAP | 07/01/2024 | 13 | $128.80 | BUY | $1,674.40 |

| APH | 07/01/2024 | 23 | $67.37 | SELL* | $1,549.51 |

| CMG | 07/01/2024 | 14 | $62.65 | SELL* | $877.10 |

| AMAT | 07/01/2024 | 4 | $235.99 | SELL* | $943.96 |

| PWR | 07/01/2024 | 5 | $254.09 | BUY* | $1,270.45 |

| GRMN | 07/01/2024 | 16 | $162.92 | BUY | $2,606.72 |

| TT | 07/01/2024 | 4 | $328.93 | HOLD* | $1,315.72 |

| LDOS | 07/01/2024 | 18 | $145.88 | BUY* | $2,625.84 |

| TER | 07/01/2024 | 7 | $148.29 | BUY | $1,038.03 |

| Total | $24,255.28 |

*We are now updating the BUY/SELL column to correctly reflect the transactions. BUY* means we buy more of an existing stock, SELL* means we sell some of the existing stocks, HOLD* means no change to the quantity of existing stocks.

The trade date for the US is on 07/01/2024 with the close prices as of 06/28/2024.

Markets in the US and India closed up for the month of May 2024. Indian markets (NIFTY500) were only slightly up after volatile trading sessions during the final phase of the ongoing general elections and a week before the results are announced. US markets continued their upward momentum driven by earnings from several companies such as Nvidia, Salesforce, Dell etc., While not all companies' stocks were up, the market (S&P500) was overall up for the month. Some of the news around bond auctions, inflation readings and fed speak did not seem to affect the markets that much and the upward trajectory is continuing.

The US markets reversed the downtrend that was experienced in April 2024. While once again there are explanations as to why the markets go up or down, those explanations are now taking a backseat in the media as the price action has been crazy. Case in point is the market was down significantly on May 31st 2024 and reversed course, closing much higher. One explanation for this phenomenon could be that the end of month algorithms were rebalancing and buying/selling various stocks of the index. Once again, as QuantMomo’s algorithms are rules based, none of the explanation matters as positions are mechanically entered and exited based on rules.

For the month of April 2024, the S&P500 was up +5.16%. The US Momo algorithm once again performed poorly compared to the S&P500 and was only up +3.24%. While a majority of the stocks went up, there were a few stocks in the portfolio which performed very poorly. The names include BLDR (-12%+), AXON (-9%+), ALGN (-8%+). The S&P500 still continues to drive its superior performance due to the Magnificent 7 stocks and others are not participating in the rally. Due to this we started to report the S&P equal weighted portfolio’s returns and in May, the equal weighted index was up only +3.19%.

| Stock Symbol | Purchase Price | Number of Shares | Current Price | Profit/Loss per Share | Profit/Loss % |

|---|---|---|---|---|---|

| NVDA | $850.77 | 1 | $1,095.95 | $245.18 | 28.82% |

| META | $428.60 | 2 | $467.29 | $38.69 | 9.03% |

| CEG | $186.25 | 6 | $217.41 | $31.16 | 16.73% |

| WDC | $70.17 | 14 | $75.31 | $5.14 | 7.33% |

| CTLT | $55.75 | 79 | $53.77 | ($1.98) | -3.55% |

| NRG | $72.95 | 16 | $81.00 | $8.05 | 11.03% |

| ALGN | $282.03 | 3 | $257.21 | ($24.82) | -8.80% |

| MU | $110.52 | 8 | $125.01 | $14.49 | 13.11% |

| GM | $44.50 | 30 | $45.01 | $0.51 | 1.15% |

| CAT | $333.38 | 3 | $338.84 | $5.46 | 1.64% |

| URI | $664.41 | 1 | $670.16 | $5.75 | 0.87% |

| ETN | $318.83 | 4 | $333.24 | $14.41 | 4.52% |

| DVA | $138.11 | 11 | $147.11 | $9.00 | 6.52% |

| AXP | $233.22 | 5 | $240.13 | $6.91 | 2.96% |

| BLDR | $183.00 | 5 | $160.93 | ($22.07) | -12.06% |

| AMAT | $196.08 | 6 | $215.08 | $19.00 | 9.69% |

| HUBB | $367.72 | 3 | $388.90 | $21.18 | 5.76% |

| AXON | $312.18 | 5 | $281.67 | ($30.51) | -9.77% |

| Total | $22,825.27 | $23,563.85 | $738.58 | 3.24% |

Following are the cumulative statistics.

The US Momo strategy is up 7.81% for the year, the S&P 500 is up 10.12% and the equal weight index is up 5.16%.

| Date | US MOMO | MOMO P&L % (Total) | S&P 500 | S&P 500 P&L % (Total) | S&P 500 (Equal Weighted Index) | S&P 500 P&L % (Total) (Equal Weighted Index) |

|---|---|---|---|---|---|---|

| 2023-12-29 | $25,000.00 | 0% | 4,742.83 | 0% | 6,401.11 | 0% |

| 2024-01-31 | $25,821.03 | 3.28% | 4,906.19 | 3.44% | 6,419.44 | 0.29% |

| 2024-02-29 | $27,350.58 | 9.40% | 5,137.08 | 8.31% | 6,633.80 | 3.64% |

| 2024-03-28 | $28,689.49 | 14.76% | 5,254.35 | 10.79% | 6,875.88 | 7.42% |

| 2024-04-30 | $26,237.11 | 4.95% | 5,099.96 | 7.53% | 6,588.53 | 2.93% |

| 2024-05-31 | $26,952.98 | 7.81% | 5,222.68 | 10.12% | 6731.41 | 5.16% |

| Stock Symbol | Trade Date | Number of Shares | Price per Share | BUY/SELL/HOLD | Total |

|---|---|---|---|---|---|

| NVDA | 06/03/2024 | 1 | $1,096.33 | HOLD* | $1,096.33 |

| CEG | 06/03/2024 | 3 | $217.25 | BUY* | $651.75 |

| GE | 06/03/2024 | 7 | $165.14 | BUY | $1,155.98 |

| NRG | 06/03/2024 | 7 | $81.00 | SELL* | $567.00 |

| MU | 06/03/2024 | 7 | $125.00 | SELL* | $875.00 |

| WDC | 06/03/2024 | 13 | $75.29 | SELL* | $978.77 |

| ETN | 06/03/2024 | 5 | $332.85 | BUY* | $1,664.25 |

| HWM | 06/03/2024 | 16 | $84.65 | BUY | $1,354.40 |

| CMG | 06/03/2024 | 1 | $3,129.52 | BUY | $3,129.52 |

| TRGP | 06/03/2024 | 14 | $118.23 | BUY | $1,655.22 |

| TT | 06/03/2024 | 4 | $327.46 | BUY | $1,309.84 |

| FANG | 06/03/2024 | 8 | $199.26 | BUY | $1,594.08 |

| QCOM | 06/03/2024 | 6 | $204.05 | BUY | $1,224.30 |

| AMAT | 06/03/2024 | 5 | $215.08 | SELL* | $1,075.40 |

| WAB | 06/03/2024 | 11 | $169.23 | BUY | $1,861.53 |

| APH | 06/03/2024 | 13 | $132.37 | BUY | $1,720.81 |

| AXP | 06/03/2024 | 7 | $240.00 | BUY* | $1,680.00 |

| PWR | 06/03/2024 | 3 | $275.94 | BUY | $827.82 |

| LDOS | 06/03/2024 | 3 | $147.05 | BUY | $441.15 |

| Total | $24863.15 |

*We are now updating the BUY/SELL column to correctly reflect the transactions. BUY* means we buy more of an existing stock, SELL* means we sell some of the existing stocks, HOLD* means no change to the quantity of existing stocks.

The trade date for the US is on 06/03/2024 with the close prices as of 05/31/2024.

Markets in the US and India performed slightly differently with US markets down for the month of April and India up slightly for April. US markets are now focused on companies’ earnings, economic data and federal reserve signaling of rates (cost of money) while the Indian markets are focused on the outcome of the general election coming up in May.

The US markets have been in a downtrend for April 2024. There have been several explanations and narratives for the down move including Inflation, GDP, expected rate moves by the Fed, Strong Employment, and erosion of liquidity. Since the momentum algorithm is rules-based and focuses on a few key variables most important of which is the price action, narratives to a large extent do not matter for such rules-based strategies.

For the month of April 2024, the S&P500 was down -3.97%. The US Momo algorithm performed much worse than the market with a return of -8.63%. A majority of the stocks were down and of the stocks that were down, many of them lost more than 10% of their value. Only 2 stocks were up and this contributed to a significant underperformance of the portfolio. As this is a rules-based strategy with a focus on generating significant alpha over the long term, such losses are short-term and cannot be avoided.

| Stock Symbol | Purchase Price | Number of Shares | Current Price | Profit/Loss per Share | Profit/Loss % |

|---|---|---|---|---|---|

| NVDA | $902.99 | 1 | $864.02 | ($38.97) | -4.32% |

| AMD | $180.10 | 5 | $158.38 | ($21.72) | -12.06% |

| BLDR | $208.65 | 6 | $182.82 | ($25.83) | -12.38% |

| UBER | $77.00 | 21 | $66.27 | ($10.73) | -13.94% |

| DECK | $947.66 | 1 | $818.47 | ($129.19) | -13.63% |

| TPR | $48.08 | 32 | $39.92 | ($8.16) | -16.97% |

| URI | $721.11 | 2 | $667.99 | ($53.12) | -7.37% |

| RL | $186.22 | 7 | $163.64 | ($22.58) | -12.13% |

| META | $487.20 | 2 | $430.17 | ($57.03) | -11.71% |

| NFLX | $608.00 | 3 | $550.64 | ($57.36) | -9.43% |

| AVGO | $1,325.68 | 1 | $1,300.27 | ($25.41) | -1.92% |

| DVA | $138.14 | 8 | $139.01 | $0.87 | 0.63% |

| LRCX | $972.03 | 1 | $894.41 | ($77.62) | -7.99% |

| AXP | $227.44 | 9 | $234.03 | $6.59 | 2.90% |

| BBWI | $50.01 | 29 | $45.42 | ($4.59) | -9.18% |

| MHK | $130.81 | 11 | $115.32 | ($15.49) | -11.84% |

| ANET | $292.28 | 3 | $256.56 | ($35.72) | -12.22% |

| CRM | $301.69 | 4 | $268.94 | ($32.75) | -10.86% |

| MPWR | $677.42 | 1 | $669.33 | ($8.09) | -1.19% |

| Total | $23,802.78 | $21,747.64 | ($2,055.14) | -8.63% |

In the US, the momentum algorithm produced +4.95% on a cumulative basis. While both the S&P500 (cap weighted index) and the S&P500 Equal Weight index have performed well US momo algorithm has produced an Alpha for Q1 2024 (when compared to the S&P500 Equal Weight index). The statistics are in the chart below.

| Date | US MOMO | MOMO P&L % (Total) | S&P 500 | S&P 500 P&L % (Total) | S&P 500 (Equal Weighted Index) | S&P 500 P&L % (Total) (Equal Weighted Index) |

|---|---|---|---|---|---|---|

| 2023-12-29 | $25,000.00 | 0% | 4,742.83 | 0% | 6,401.11 | 0% |

| 2024-01-31 | $25,821.03 | 3.28% | 4,906.19 | 3.44% | 6,419.44 | 0.29% |

| 2024-02-29 | $27,350.58 | 9.40% | 5,137.08 | 8.31% | 6,633.80 | 3.64% |

| 2024-03-28 | $28,689.49 | 14.76% | 5,254.35 | 10.79% | 6,875.88 | 7.42% |

| 2024-04-30 | $26,237.11 | 4.95% | 5,099.96 | 7.53% | 6,588.53 | 2.93% |

| Stock Symbol | Trade Date | Number of Shares | Price per Share | BUY/SELL/HOLD | Total |

|---|---|---|---|---|---|

| NVDA | 05/01/2024 | 1 | $903.56 | HOLD* | $903.56 |

| AMD | 05/01/2024 | 5 | $180.49 | BUY* | $902.45 |

| BLDR | 05/01/2024 | 6 | $208.55 | SELL* | $1,251.30 |

| UBER | 05/01/2024 | 21 | $76.99 | BUY* | $1,616.79 |

| DECK | 05/01/2024 | 1 | $941.26 | BUY | $941.26 |

| TPR | 05/01/2024 | 32 | $47.48 | BUY* | $1,519.36 |

| URI | 05/01/2024 | 2 | $721.11 | HOLD | $1,442.22 |

| RL | 05/01/2024 | 7 | $187.76 | BUY* | $1,314.32 |

| META | 05/01/2024 | 2 | $485.58 | BUY* | $971.16 |

| NFLX | 05/01/2024 | 3 | $607.33 | BUY* | $1,821.99 |

| AVGO | 05/01/2024 | 1 | $1,325.41 | HOLD* | $1,325.41 |

| DVA | 05/01/2024 | 8 | $138.05 | BUY | $1,104.40 |

| LRCX | 05/01/2024 | 1 | $971.57 | BUY | $971.57 |

| AXP | 05/01/2024 | 9 | $227.69 | BUY | $2,049.21 |

| BBWI | 05/01/2024 | 29 | $50.02 | BUY | $1,450.58 |

| MHK | 05/01/2024 | 11 | $130.89 | BUY | $1,439.79 |

| ANET | 05/01/2024 | 3 | $289.98 | HOLD | $869.94 |

| CRM | 05/01/2024 | 4 | $301.18 | SELL* | $1,204.72 |

| MPWR | 05/01/2024 | 1 | $677.42 | HOLD* | $677.42 |

| Total | $23,777.45 |

*We are now updating the BUY/SELL column to correctly reflect the transactions. BUY* means we buy more of an existing stock, SELL* means we sell some of the existing stocks, HOLD* means no change to the quantity of existing stocks.

The trade date for the US is on 05/01/2024 with the close prices as of 04/30/2024.

The US markets continued to move up driven by a combination of earnings data, Inflation readings and the Federal Reserve decision. At this stage in the business cycle, most economists are calling for no recession as the economy continues to move along with record employment statistics. However, there may be a few anomalies in data and reporting which are much beyond the scope of what we do here at QuantMomo which is to follow rules and invest our capital. Indian markets had a rough March 2024 driven by selling in small-cap and micro-cap stocks. The market action has been very volatile and the prevailing narrative was that foreign investors took capital out (Ex: Whirlpool). While narratives are good for telling a story, they may not reveal the underlying reasons for the price action, and in our experience, there is always more to it than what the narrative says.

In the US market, the price action for March was driven by a few key data points and the remainder of the earnings from a few companies. The S&P is now at all-time highs with momentum and the magnificent 7 stocks performing extremely well.

For the month of March 2024, S&P500 returned +2.28%. The US Momo algorithm continued to outperform the market in March 2024 and returned +5.13%. A few stocks rallied more than 5% and some of them such as NRG and PHM were up more than 10%.

| Stock Symbol | Purchase Price | Number of Shares | Current Price | Profit/Loss per Share | Profit/Loss % |

|---|---|---|---|---|---|

| AMD | $197.91 | 3 | $180.49 | ($17.42) | -8.80% |

| UBER | $79.50 | 8 | $76.99 | ($2.51) | -3.16% |

| AVGO | $1,325.93 | 1 | $1,325.41 | ($0.52) | -0.04% |

| FICO | $1,266.48 | 1 | $1,249.61 | ($16.87) | -1.33% |

| ALL | $158.46 | 18 | $173.01 | $14.55 | 9.18% |

| NVDA | $800.00 | 1 | $903.56 | $103.56 | 12.95% |

| ANET | $281.60 | 3 | $289.98 | $8.38 | 2.98% |

| RL | $186.21 | 3 | $187.76 | $1.55 | 0.83% |

| MPWR | $726.95 | 1 | $677.42 | ($49.53) | -6.81% |

| URI | $693.45 | 2 | $721.11 | $27.66 | 3.99% |

| META | $492.11 | 1 | $485.58 | ($6.53) | -1.33% |

| BLDR | $195.07 | 8 | $208.55 | $13.48 | 6.91% |

| PHM | $108.38 | 14 | $120.62 | $12.24 | 11.29% |

| TPR | $47.76 | 23 | $47.48 | ($0.28) | -0.59% |

| COF | $137.72 | 15 | $148.89 | $11.17 | 8.11% |

| QCOM | $159.39 | 8 | $169.30 | $9.91 | 6.22% |

| NRG | $55.78 | 36 | $67.69 | $11.91 | 21.35% |

| CRM | $307.00 | 5 | $301.18 | ($5.82) | -1.90% |

| NFLX | $599.81 | 2 | $607.33 | $7.52 | 1.25% |

| EXPE | $136.30 | 4 | $137.75 | $1.45 | 1.06% |

| Total | $24,288.99 | $25,533.86 | $1,244.87 | 5.13% |

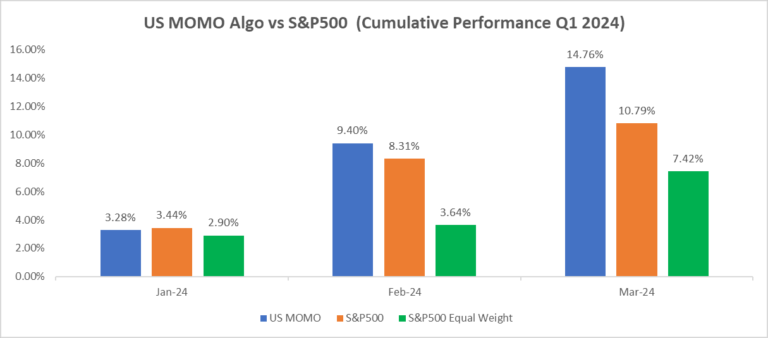

In the US, the momentum algorithm produced +14.76% on a cumulative basis. If one invested $100K in the strategy on January 1st, they would have made $14760. While both the S&P500 (cap weighted index) and the S&P500 Equal Weight index have performed well US momo algorithm has produced an Alpha for Q1 2024. The statistics are in the chart below.

| Date | US MOMO | MOMO P&L % (Total) | S&P 500 | S&P 500 P&L % (Total) | S&P 500 (Equal Weighted Index) | S&P 500 P&L % (Total) (Equal Weighted Index) |

|---|---|---|---|---|---|---|

| 2023-12-29 | $25,000.00 | 0% | 4,742.83 | 0% | 6,401.11 | 0% |

| 2024-01-31 | $25,821.03 | 3.28% | 4,906.19 | 3.44% | 6,419.44 | 0.29% |

| 2024-02-29 | $27,350.58 | 9.40% | 5,137.08 | 8.31% | 6,633.80 | 3.64% |

| 2024-03-28 | $28,689.49 | 14.76% | 5,254.35 | 10.79% | 6,875.88 | 7.42% |

| Stock Symbol | Trade Date | Number of Shares | Price per Share | BUY/SELL/HOLD | Total |

|---|---|---|---|---|---|

| NVDA | 04/01/2024 | 1 | $903.56 | HOLD* | $903.56 |

| AMD | 04/01/2024 | 5 | $180.49 | BUY* | $902.45 |

| BLDR | 04/01/2024 | 6 | $208.55 | SELL* | $1,251.30 |

| UBER | 04/01/2024 | 21 | $76.99 | BUY* | $1,616.79 |

| DECK | 04/01/2024 | 1 | $941.26 | BUY | $941.26 |

| TPR | 04/01/2024 | 32 | $47.48 | BUY* | $1,519.36 |

| URI | 04/01/2024 | 2 | $721.11 | HOLD | $1,442.22 |

| RL | 04/01/2024 | 7 | $187.76 | BUY* | $1,314.32 |

| META | 04/01/2024 | 2 | $485.58 | BUY* | $971.16 |

| NFLX | 04/01/2024 | 3 | $607.33 | BUY* | $1,821.99 |

| AVGO | 04/01/2024 | 1 | $1,325.41 | HOLD* | $1,325.41 |

| DVA | 04/01/2024 | 8 | $138.05 | BUY | $1,104.40 |

| LRCX | 04/01/2024 | 1 | $971.57 | BUY | $971.57 |

| AXP | 04/01/2024 | 9 | $227.69 | BUY | $2,049.21 |

| BBWI | 04/01/2024 | 29 | $50.02 | BUY | $1,450.58 |

| MHK | 04/01/2024 | 11 | $130.89 | BUY | $1,439.79 |

| ANET | 04/01/2024 | 3 | $289.98 | HOLD | $869.94 |

| CRM | 04/01/2024 | 4 | $301.18 | SELL* | $1,204.72 |

| MPWR | 04/01/2024 | 1 | $677.42 | HOLD* | $677.42 |

| Total | $23,777.45 |

*We are now updating the BUY/SELL column to correctly reflect the transactions. BUY* means we buy more of an existing stock, SELL* means we sell some of the existing stocks, HOLD* means no change to the quantity of existing stocks.

The trade date for the US is on 04/01/2024 with the close prices as of 03/28/2024.

The US markets have been on an uptrend since November 2023 and it has continued into February 2024. The earnings of most of the S&P 500 companies are now out and most companies have posted record earnings with mostly in-line guidance for the future. All the indexes are at all-time highs in the US as of this writing. Indian markets have also been up for the year and the month of February. It remains to be seen where we go from here given the all-time highs in the US markets and the upcoming elections in May in India.

In the US market, February was mostly about earnings from a variety of companies in the S&P 500, Nasdaq, and other indexes. All the indexes are trading at very high levels given the earnings, the economic growth and the Federal Reserve’s pausing the interest rates. The trend of the market is up and the momentum stocks are doing very well.

For the month of February 2024, S&P 500 returned +3.87%. The US Momo algorithm continued to outperform the market in February 2024 and returned +5.88%. A few stocks rallied more than 10% again in the month of February 2024 and it took the overall performance up for the portfolio.

| Stock Symbol | Purchase Price | Number of Shares | Current Price | Profit/Loss per Share | Profit/Loss % |

|---|---|---|---|---|---|

| ALL | $154.34 | 13 | $159.52 | $5.18 | 3.36% |

| NRG | $53.08 | 28 | $55.32 | $2.24 | 4.22% |

| FICO | $1,198.83 | 1 | $1,269.91 | $71.08 | 5.93% |

| PANW | $339.00 | 3 | $310.55 | ($28.45) | -8.39% |

| UBER | $66.12 | 18 | $79.50 | $13.38 | 20.24% |

| AMD | $169.27 | 4 | $192.53 | $23.26 | 13.74% |

| EXPE | $148.99 | 9 | $136.82 | ($12.17) | -8.17% |

| ANET | $262.00 | 3 | $277.54 | $15.54 | 5.93% |

| IT | $457.59 | 4 | $465.56 | $7.97 | 1.74% |

| INTC | $43.15 | 15 | $43.05 | ($0.10) | -0.23% |

| AVGO | $1,187.35 | 1 | $1,300.49 | $113.14 | 9.53% |

| STX | $85.88 | 13 | $93.05 | $7.17 | 8.35% |

| NOW | $769.09 | 2 | $771.34 | $2.25 | 0.29% |

| PGR | $176.77 | 9 | $189.56 | $12.79 | 7.24% |

| LULU | $454.90 | 3 | $467.09 | $12.19 | 2.68% |

| QCOM | $140.87 | 7 | $157.79 | $16.92 | 12.01% |

| AXON | $250.65 | 6 | $307.37 | $56.72 | 22.63% |

| MU | $86.07 | 13 | $90.61 | $4.54 | 5.27% |

| WRK | $40.00 | 34 | $45.29 | $5.29 | 13.23% |

| KEY | $14.55 | 62 | $14.27 | ($0.28) | -1.92% |

| Total | $24,848.85 | $26,308.80 | $1,459.95 | 5.88% |

Following are the cumulative statistics.

The US Momo strategy is up 9.40% for the year, the S&P 500 is up 8.31% and the equal weight index is up 3.64%.

| Date | US MOMO | MOMO P&L % (Total) | S&P 500 | S&P 500 P&L % (Total) | S&P 500 (Equal Weighted Index) | S&P 500 P&L % (Total) (Equal Weighted Index) |

|---|---|---|---|---|---|---|

| 2023-12-29 | $25,000.00 | 0% | 4,742.83 | 0% | 6,401.11 | 0% |

| 2024-01-31 | $25,821.03 | 3.28% | 4,906.19 | 3.44% | 6,419.44 | 0.29% |

| 2024-02-29 | $27,350.58 | 9.40% | 5,137.08 | 8.31% | 6,633.80 | 3.64% |

| Stock Symbol | Trade Date | Number of Shares | Price per Share | BUY/SELL/HOLD | Total |

|---|---|---|---|---|---|

| AMD | 03/01/2024 | 3 | $197.91 | SELL* | $593.73 |

| UBER | 03/01/2024 | 8 | $79.50 | SELL* | $636.00 |

| AVGO | 03/01/2024 | 1 | $1,325.93 | HOLD* | $1,325.93 |

| FICO | 03/01/2024 | 1 | $1,266.48 | HOLD* | $1,266.48 |

| ALL | 03/01/2024 | 18 | $158.46 | BUY* | $2,852.28 |

| NVDA | 03/01/2024 | 1 | $800.00 | BUY | $800.00 |

| ANET | 03/01/2024 | 3 | $281.60 | HOLD* | $844.80 |

| RL | 03/01/2024 | 3 | $186.21 | BUY | $558.63 |

| MPWR | 03/01/2024 | 1 | $726.95 | BUY | $726.95 |

| URI | 03/01/2024 | 2 | $693.45 | BUY | $1,386.90 |

| META | 03/01/2024 | 1 | $492.11 | BUY | $492.11 |

| BLDR | 03/01/2024 | 8 | $195.07 | BUY | $1,560.56 |

| PHM | 03/01/2024 | 14 | $108.38 | BUY | $1,517.32 |

| TPR | 03/01/2024 | 23 | $47.76 | BUY | $1,098.48 |

| COF | 03/01/2024 | 15 | $137.72 | BUY | $2,065.80 |

| QCOM | 03/01/2024 | 8 | $159.39 | BUY* | $1,275.12 |

| NRG | 03/01/2024 | 36 | $55.78 | BUY* | $2,008.08 |

| CRM | 03/01/2024 | 5 | $307.00 | BUY | $1,535.00 |

| NFLX | 03/01/2024 | 2 | $599.81 | BUY | $1,199.62 |

| EXPE | 03/01/2024 | 4 | $136.30 | SELL* | $545.20 |

| Total | $24,288.99 |

*We are now updating the BUY/SELL column to correctly reflect the transactions. BUY* means we buy more of an existing stock, SELL* means we sell some of the existing stocks, HOLD* means no change to the quantity of existing stocks.

The trade date for the US is on 03/01/2024 with the close prices as of 02/29/2024.

January has been a good month overall for both the Indian and US stock markets. The US market declined a bit during the first week but then reversed the losses and rallied to close at all-time highs in the past 3 years. Most of the earnings for Q4’2023 are now being reported in the US market and while earnings have been slightly lower, the futures expectations present a mixed picture. Indian markets have been mixed for most of January but the overall trend is still up given the performance of multiple indices.

Change to Purchase Price

In the past year, we reported statistics based on the day the algorithm ran and generated the recommendations. The purchase price was assumed to be the closing price on the day the algorithm was run. From this month, we are switching to reporting our purchase prices (which are based mostly on the opening prices on the day of trading) rather than the closing prices that we used to show. This makes the data more realistic. Our Followers’ returns may vary based on the price at which they purchase shares.

The S&P500 in the US started with a loss in the first week but then reversed course and rallied higher with news about inflation, and positive earnings from companies such as Netflix and others. However, the economic picture in the US is mixed now with many tech layoffs being announced everyday and the Federal Reserve holding rates at 5.25% to 5.5%..

For the month of January 2024, S&P500 returned +2.17%. The US Momo algorithm outperformed the overall market for January 2024 and returned +3.34%. Many stocks rallied more than 10% as can be seen in the statistics below.

| Stock Symbol | Purchase Price | Number of Shares | Current Price | Profit/Loss per Share | Profit/Loss % |

|---|---|---|---|---|---|

| WRK | $41.52 | 25 | $40.26 | ($1.26) | -3.03% |

| ANET | $234.00 | 5 | $258.68 | $24.68 | 10.55% |

| NRG | $51.50 | 32 | $53.04 | $1.54 | 2.99% |

| FICO | $1,152.40 | 1 | $1,198.83 | $46.43 | 4.03% |

| PGR | $159.80 | 7 | $178.25 | $18.45 | 11.55% |

| ALL | $140.33 | 10 | $155.25 | $14.92 | 10.63% |

| CBOE | $178.36 | 7 | $183.85 | $5.49 | 3.08% |

| AIZ | $168.49 | 9 | $167.95 | ($0.54) | -0.32% |

| STX | $84.70 | 12 | $85.68 | $0.98 | 1.16% |

| INTC | $49.20 | 15 | $43.08 | ($6.12) | -12.44% |

| AXON | $254.47 | 6 | $249.06 | ($5.41) | -2.13% |

| AKAM | $117.14 | 22 | $123.23 | $6.09 | 5.20% |

| CEG | $116.40 | 7 | $122.00 | $5.60 | 4.81% |

| SNPS | $507.95 | 2 | $533.35 | $25.40 | 5.00% |

| MOH | $362.37 | 3 | $356.44 | ($5.93) | -1.64% |

| LULU | $508.57 | 2 | $453.82 | ($54.75) | -10.77% |

| UBER | $60.73 | 18 | $65.27 | $4.54 | 7.48% |

| LLY | $580.41 | 2 | $645.61 | $65.20 | 11.23% |

| IT | $446.82 | 3 | $457.44 | $10.62 | 2.38% |

| WDC | $51.76 | 17 | $57.25 | $5.49 | 10.61% |

| Total | $24,562.82 | $25,383.85 | $821.03 | 3.34% |

| Stock Symbol | Trade Date | Number of Shares | Price per Share | BUY/SELL/HOLD | Total |

|---|---|---|---|---|---|

| ALL | 2/1/2024 | 13 | $155.25 | BUY* | $2,018.25 |

| NRG | 2/1/2024 | 28 | $53.04 | SELL* | $1,485.12 |

| FICO | 2/1/2024 | 1 | $1,198.83 | HOLD | $1,198.83 |

| PANW | 2/1/2024 | 3 | $338.51 | BUY | $1,015.53 |

| UBER | 2/1/2024 | 18 | $65.27 | HOLD | $1,174.86 |

| AMD | 2/1/2024 | 4 | $167.69 | BUY | $670.76 |

| EXPE | 2/1/2024 | 9 | $148.33 | BUY | $1,334.97 |

| ANET | 2/1/2024 | 3 | $258.68 | SELL* | $776.04 |

| IT | 2/1/2024 | 4 | $457.44 | BUY* | $1,829.76 |

| INTC | 2/1/2024 | 15 | $43.08 | HOLD | $646.20 |

| AVGO | 2/1/2024 | 1 | $1,180.00 | BUY | $1,180.00 |

| STX | 2/1/2024 | 13 | $85.68 | BUY* | $1,113.84 |

| NOW | 2/1/2024 | 2 | $765.40 | BUY | $1,530.80 |

| PGR | 2/1/2024 | 9 | $178.25 | BUY* | $1,604.25 |

| LULU | 2/1/2024 | 3 | $453.82 | BUY* | $1,361.46 |

| QCOM | 2/1/2024 | 7 | $148.51 | BUY | $1,039.57 |

| AXON | 2/1/2024 | 6 | $249.06 | HOLD | $1,494.36 |

| MU | 2/1/2024 | 13 | $85.75 | BUY | $1,114.75 |

| WRK | 2/1/2024 | 34 | $40.26 | BUY* | $1,368.84 |

| KEY | 2/1/2024 | 62 | $14.53 | BUY | $900.86 |

| Total | $24,859.05 |

*We are now updating the BUY/SELL column to correctly reflect the transactions. BUY* means we buy more of an existing stock, SELL* means we sell some of the existing stocks, HOLD* means no change to the quantity of existing stocks.

The trade date for the US is on 02/01/2024 with the close prices as of 01/31/2024.

The QuantMomo team started investing in the USA Momentum Strategy live in their accounts. The trades were placed in the market on January 1st 2024. We will use $25,000 as the allocation for this portfolio and track its performance over the course of the year.

Note: The momentum strategy rebalances its positions every month.

| Stock Symbol | Trade Date | Number of Shares | Price per Share | BUY/SELL/HOLD | Total |

|---|---|---|---|---|---|

| WRK | 01/01/2024 | 25 | $41.52 | SELL* | $1,038.00 |

| ANET | 01/01/2024 | 5 | $235.51 | SELL* | $1,177.55 |

| NRG | 01/01/2024 | 32 | $51.70 | BUY* | $1,654.40 |

| FICO | 01/01/2024 | 1 | $1,164.01 | SELL* | $1,164.01 |

| PGR | 01/01/2024 | 7 | $159.28 | SELL* | $1,114.96 |

| ALL | 01/01/2024 | 10 | $139.98 | BUY | $1,399.80 |

| CBOE | 01/01/2024 | 7 | $178.56 | SELL* | $1,249.92 |

| AIZ | 01/01/2024 | 9 | $168.49 | BUY* | $1,516.41 |

| STX | 01/01/2024 | 12 | $85.37 | BUY | $1,024.44 |

| INTC | 01/01/2024 | 15 | $50.25 | BUY | $753.75 |

| AXON | 01/01/2024 | 6 | $258.33 | BUY | $1,549.98 |

| AKAM | 01/01/2024 | 22 | $118.35 | SELL* | $2,603.70 |

| CEG | 01/01/2024 | 7 | $116.89 | SELL* | $818.23 |

| SNPS | 01/01/2024 | 2 | $514.91 | BUY | $1,029.82 |

| MOH | 01/01/2024 | 3 | $361.31 | SELL* | $1,083.93 |

| LULU | 01/01/2024 | 2 | $511.29 | BUY | $1,022.58 |

| UBER | 01/01/2024 | 18 | $61.57 | BUY | $1,108.26 |

| LLY | 01/01/2024 | 2 | $582.92 | HOLD | $1,165.84 |

| IT | 01/01/2024 | 3 | $451.11 | BUY | $1,353.33 |

| WDC | 01/01/2024 | 17 | $52.37 | BUY | $890.29 |

| $24,719.20 |