As most of our followers are aware, the FY 2024-25 year has now come to a close on March 31st 2025. In continuing our tradition of updating our followers, we will now review QuantMomo strategy performance for the Financial Year and also provide some data about comparisons with competitor ETF (Exchange Traded Funds) and Mutual Fund products.

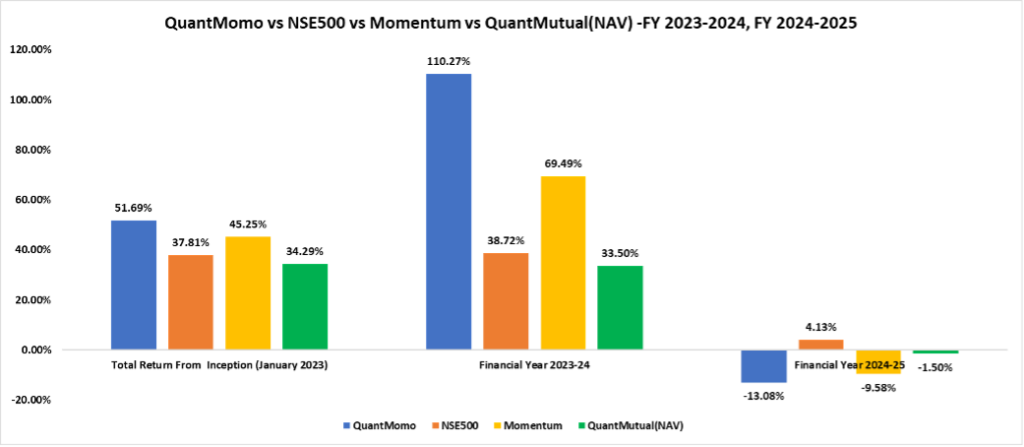

The Momentum strategy had a rough year and ended down 13.08% for the financial year. However, the strategy has outperformed both the Index and competitors since Inception. While we can provide many reasons for why the strategy underperformed, a couple of them are worth mentioning:

Since it is a rules-based strategy, we do not tweak the rules, and one future initiative that we are actively working on is to provide more strategies that can better hedge the drawdowns and losses. The all-weather strategy has been an excellent hedge, as you will see in the following sections.

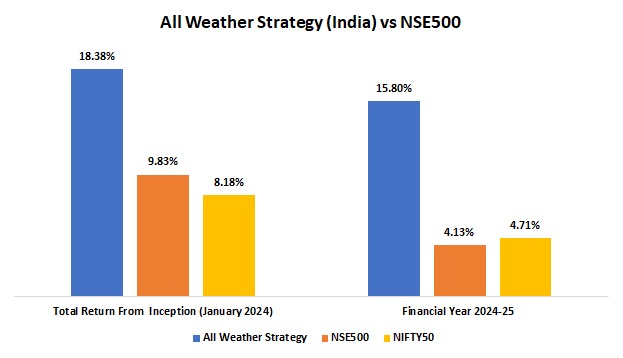

In January 2024, QuantMomo added the All-Weather strategy to minimize the drawdowns and enable investors with a SWAN (Sleep Well At Night) approach. The strategy included 5 assets comprising Equities (NSE500 Index), Gold, Silver, and bonds (5-year GILT and 10-year GILT). We are pleased to report that the strategy performed in line with its goals. The strategy has produced an alpha in the financial year thanks to Gold and Silver rallying to all-time highs.

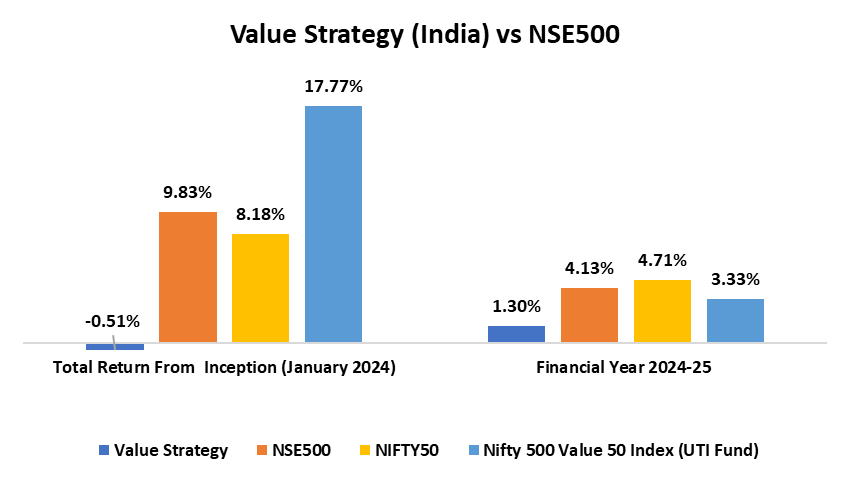

In January 2024, QuantMomo also added a value strategy. Value is a factor investment strategy with a focus on identifying stocks which offer the best value for the price of the stock. The focus of this strategy is to identify stocks with compelling valuation metrics on their balance sheet and income statements and rebalancing them yearly. In the recent past, value stocks have underperformed compared to growth stocks and this strategy is a very long term strategy to ride the resurgence of value stocks when it happens. History has shown that value stocks tend to eventually outperform. While we won’t go into the details of the statistics, we would like to mention that there is a lot of research on the public domain about value stocks and we encourage our followers to review them. QuantMomo’s Value strategy did not perform well but did not lose a lot of money and the performance is flat.

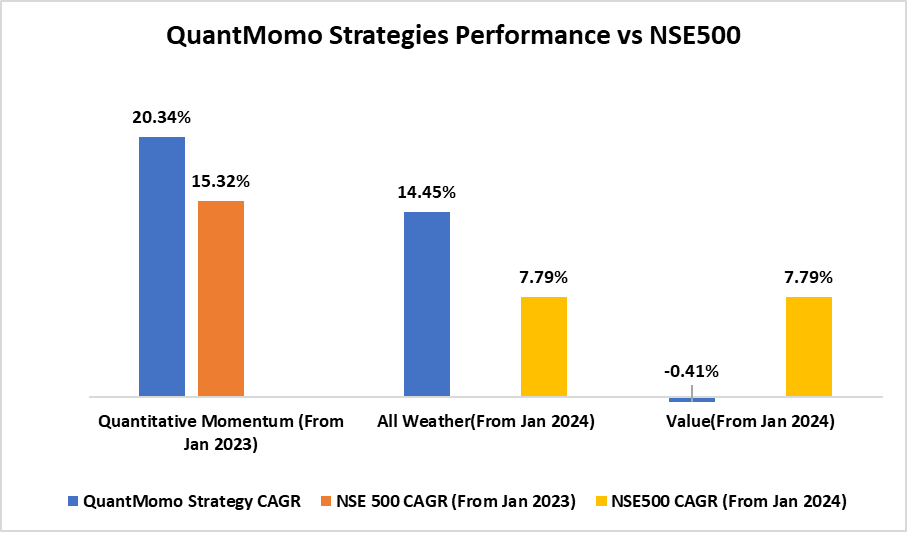

Many of our followers asked us about the CAGR for the different strategies that we are providing and investing our own capital. Here is a snapshot of the CAGR for all of the strategies with a comparison against NSE500 (Multicap index).

The CAGR chart above shows that an investor can mix quantitative rules based strategies in a variety of ratios (allocation mix) to generate an outperformance against a benchmark index. Until today, our focus at QuantMomo has been to use Data as a foundation to curate such rules based strategies. In addition, we have introduced an application (Mobile App available on Android and Apple Store) which can be used by investors to allocate capital to such strategies. Going forward, our focus is twofold:

We are actively working on both these focus areas and will update you all in the coming months. In the meantime, I encourage all High Net Worth Investors (HNIS) to give us a try. The company is growing and we are actively raising funds to scale. If you are interested in partnering with or investing in QuantMomo, feel free to drop us a line at [email protected]